Organized by

Co-Host

Date and Venue

SATURDAY, 31ST MAY 2025

10.30 AM to 5.00pm

The Zone

Plot 9 Gbagada Industrial Scheme, Beside UPS, Gbagada Expressway, Lagos

INFRACONNECT, ORGANIZED BY THE AFRICAN CATALYST IS A PLATFORM DESIGNED TO FACILITATE MEANINGFUL CONNECTIONS BETWEEN VARIOUS STAKEHOLDERS IN THE EARLY STAGES OF INFRASTRUCTURE PROJECTS.

InfraConnect serves as a bridge between project owners (developers), enablers (consultants, advisors, government agencies), and capital providers (investors, banks, financial institutions).

It aims to foster relationships and collaborations that can drive the successful initiation and execution of infrastructure projects.

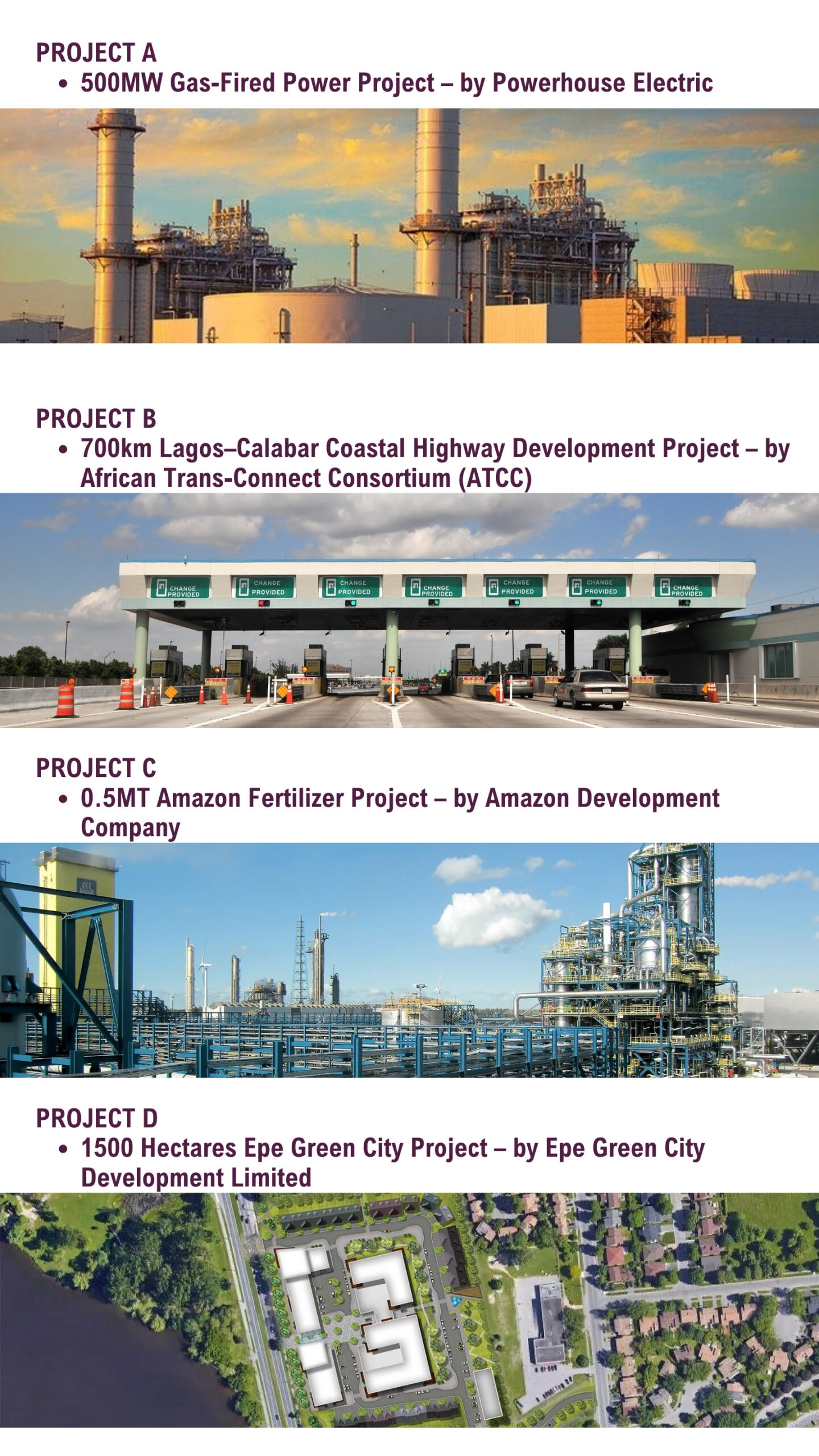

A major highlight of InfraConnect Is the #InfraPitch, which is an Early Stage Infrastructure Project Pitching Session of a Cohort of attendees in Developing & Financing Infrastructure Project Programme (DFIP)

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

The InfraPitch Session

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Why Attend InfraConnect

Pre-Qualified Attendees

Our team of professionals ensure the authenticity of all the developers and investors involved in one-to-one meetings along with the legitimacy of their requirements.

Value-driven Interaction

Our agenda-driven approach to these meetings ensures that the interaction is substantial and productive for all the stakeholders involved.

Structured Networking Breaks

Structured Event Networking is an effective way to direct conversations with new individuals, eliminating the need for awkward small talk

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Attendees and Particpants

Project Owners

These are Companies that provide the CONCEIVE & DEVELOP PROJECT AS PROMOTERS of Infrastructure & Lareg Scale Industrial Projects

- INFRASTRUCTURE STARTUPS

- PROJECT DEVELOPERS

- PROJECT SPONSORS

- DEVELOPMENT PARTNERS

- GREENFIELD DEVELOPMENTS

- BROWNFIELD DEVELOPMENTS

- PROJECT OWNERS

Project Enablers

Companies that provide the RIGHT ENABLEMENT to Infrastructure Project Development such as

- ENGINEERING DESIGN CONSULTANTS

- EPC CONTRACTORS,

- EPIC CONTRACTORS

- CONTRUCTION PROFESSIONALS

- FEEDSTOCK SUPPLY (GAS & MINERALS)

- OPERATIONS & MANAGEMENT CONTRACTORS

- LEGAL ADVISORY SERVICES

- ENVIRONMENTAL SOCIAL GOVERNANCE

- FREE ZONE AGENCIES

- PUBLIC SECTOR STATE INVESTMENT AGENCY

- PUBLIC SECTOR INFRASTRUCTURE MINISTRIES

Early Stage Capital Partners

These are includes Companies that provide the CO-DEVELOPMENT EXPERTISE AND SEED CAPITAL to Infrastructure Project Development such as

- DEVELOPMENT PARTNERS,

- PROJECT PREPARATION AGENCIES

- ANGEL INVESTORS

- VENTURE CAPITALIST

- PRIVATE EQUITY

- PHILANTROPHY

- IMPACT INVESTING

- INFRASTRUCTURE FUNDS

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Event Agenda

Agenda

Registration & Networking

Pre-Conference and Main Conference Registration Desk Open

Registration Area

Welcome Introduction

The Event MC will kick off the program with a warm welcome, setting the tone for the day. This introduction will provide an overview of the event schedule, highlight key sessions and speakers, and ensure participants are oriented about the day's activities.

Fire Side Chat

This fireside chat with the Lead Partner, Mr. Femi Awofala, will provide valuable insights into the vision and strategic direction of The African Catalyst, highlighting our programs, initiatives, and ongoing efforts to accelerate the development of infrastructure projects across the continent.

Introduction to #DFIP InfraPitch Session

This session introduces the InfraPitch, a culminating showcase of the DFIP program, where groups present infrastructure project pitches that reflect the knowledge, collaboration, and practical insights gained throughout their DFIP journey. The InfraPitch highlights the application of key concepts such as bankability, sustainability, and financial structuring, offering a platform to demonstrate both individual growth and collective achievement.

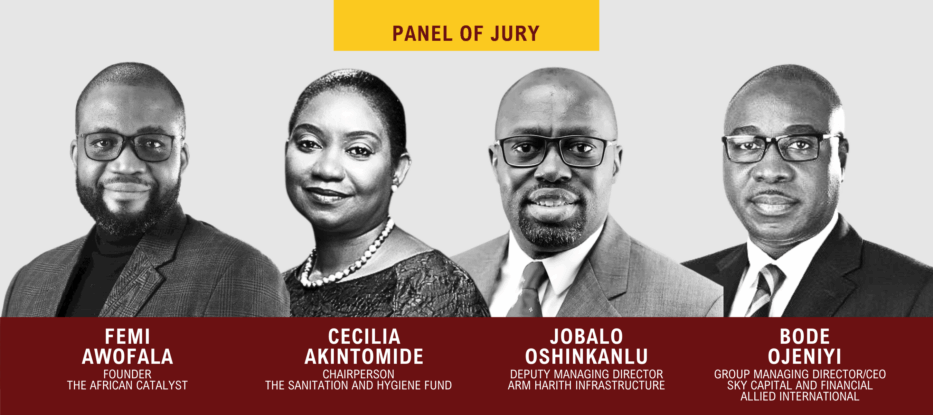

InfraPitch Presentations with Q&A

The InfraPitch Q&A session will offer both attendees and the jury an opportunity to engage directly with the presenting groups, delving into the challenges, opportunities, and strategic approaches embedded in their infrastructure project pitches.

InfraPitch Presentations Winner Annoucement

This session marks the culmination of the InfraPitch showcase with the announcement and awarding of the winning teams. These groups have demonstrated exceptional creativity, analytical depth, and a strong grasp of infrastructure project development principles.

InfraPitch Remarks/Annoucements by MC

This session will feature closing remarks from the event MC, offering a brief reflection on the highlights of the day, key takeaways from the InfraPitch, and appreciation to all participants, jurors, and partners. It will serve as a moment to celebrate the collective efforts of The African Catalyst

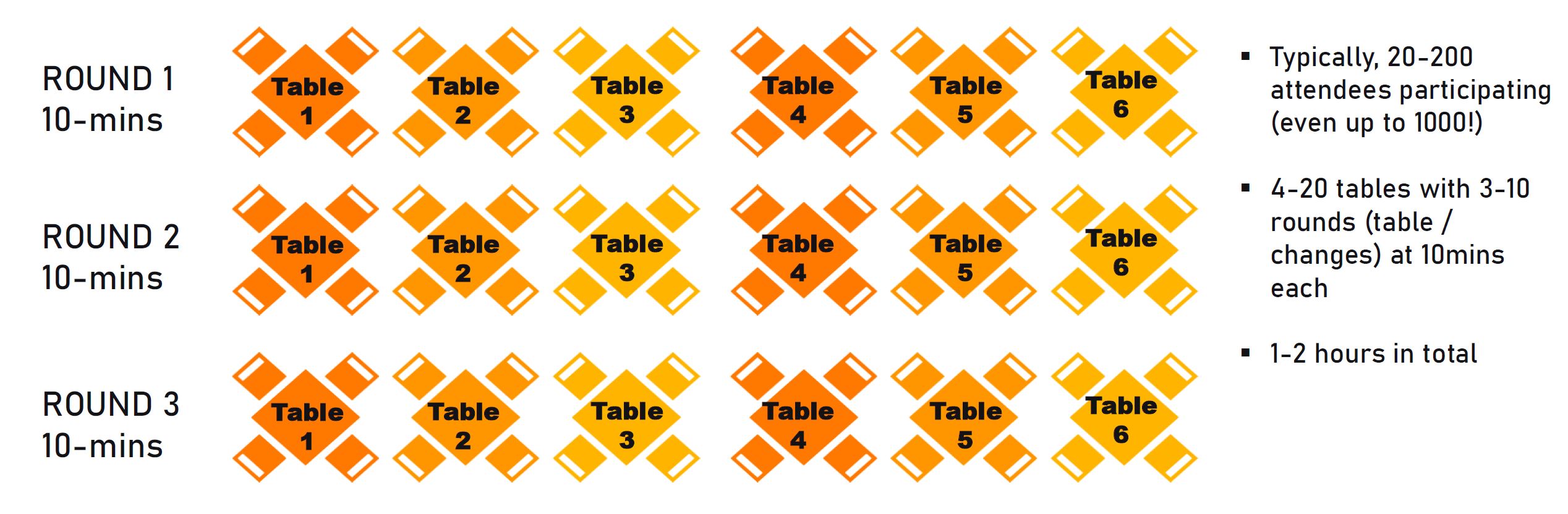

Introducing Structured Event Networking

Structured Event Networking is a timed activity that is designed to facilitate quick, face-to-face interactions between delegates.

Participants in the Structured Event Networking session have a limited amount of time to engage in a conversation and the goal is to allow attendees to make new connections, exchange information, and explore potential partnerships.

Closing Remarks

A light snack break will be provided, offering attendees a chance to refresh, network informally, and connect with fellow participants, jurors, and facilitators before the next session begins.

Snack Break & Drinks

A light snack break will be provided, offering attendees a chance to refresh, network informally, and connect with fellow participants, jurors, and facilitators before the next session begins.

Structured Networking Session

The structured event networking session begins, a guided networking experience designed to foster meaningful connections among participants, jurors, mentors, and industry professionals.

Attendees will have the opportunity to share insights, explore collaboration opportunities, and expand their professional networks within the infrastructure ecosystem.

Final Close-Out

Final Event Close out and Thank you my MC

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Structured Networking Session

A major session within InfraConnect is 2 hours of Structured Networking

31st May 2025

10.30 AM to 5.00pm

The Zone

Plot 9 Gbagada Industrial Scheme, Beside UPS, Gbagada Expressway, Lagos

Register to attend

In-Person

ASSIGN PEOPLE TO TABLE IN EACH ROUND SO THAT EACH PERSON HAS MET THE LARGEST NUMBER OF UNIQUE PEOPLE

- Instead of meeting just one person at a time, participants, typically 4-10 people at one table meet for sessions (rounds) that last a couple of minutes each.

- Only one person at a table speaks at a time. When everybody at each table has finished, the session ends.

- Everyone moves on to the next, pre-assigned table to meet a brand-new group of people.

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Get Involved

Secure a Display Area

At InfraConnect, you will have the opportunity to also showcase your products and services by securing a display area. This area will be adjacent to the conference room.

Don’t miss the chance to increase your visibility at the event; the display area will help you get new clients!

Be a Speaker

The InfraConnect is a platform for you to share your leadership insights on infrastructure development in Africa.

If you would like to be a speaker, please send us your biography and expertise. This information will help us determine the session topics that best align with your experience and knowledge, allowing us to collaboratively define the most impactful sessions for you to contribute to.

Become a Sponsor

By becoming a sponsor of InfraConnect, you play a crucial role in its success. Your contributions can support program materials, networking events, and mentorship opportunities, enhancing the experience for all participants.

Your sponsorship of InfraConnect helps foster meaningful connections between stakeholders in the infrastructure sector, driving the development of impactful projects and promoting sustainable growth.

Ready to ATTEND InfraCONNECT ?

Contact us today for more information ! or Call +2349043011001 (Direct Line)

Register for InfraConnect 2.0

ATTEND IN-PERSON

- In-Person Structured Networking

- In-Person Attendance for InfraPitch Sesssion

In-person Participation (N50,000)

Online CARD PAYMENTS to make transfer to ANY of Nigeria Bank Account below:

- AFRICAN CATALYST RESOURCES

- 1312940707

- ZENITH BANK

Upon payment please send payment receipt to receipts(at)theafricancatalyst.com for confirmation and Enrollment and Whatpp +2349061687091

ATTEND ONLINE

Online Participation (Free)