The sizzling

InfraConnect 1.0

How InfraConnect Went!

WHY WE ARE

BEST CHOICE?

• Beginner Friendly

• Renowned Speakers

• Hands-on Workshops

• Networking Opportunities

• And much more!

InfraConnect, hosted by The African Catalyst, is a networking hub for key stakeholders in Africa's infrastructure ecosystem, such as project developers, investors, and enablers. It addresses early-stage infrastructure development challenges by facilitating meaningful engagements, one-on-one meetings, and structured networking sessions, ultimately bridging the gap between projects and funding opportunities.

Sessions

Mr Babafemi Awofala

Mel de Nysschen

Moderator:

Chinenye Ajayi

Panelists:

Femi Awofala – Lead Partner, Brickstone

Josh Egba – West Africa Rep, USTDA

Felix Rwang – Chairman, APBN

Ladi Sanni – Managing Director, Starsight

Moderator:

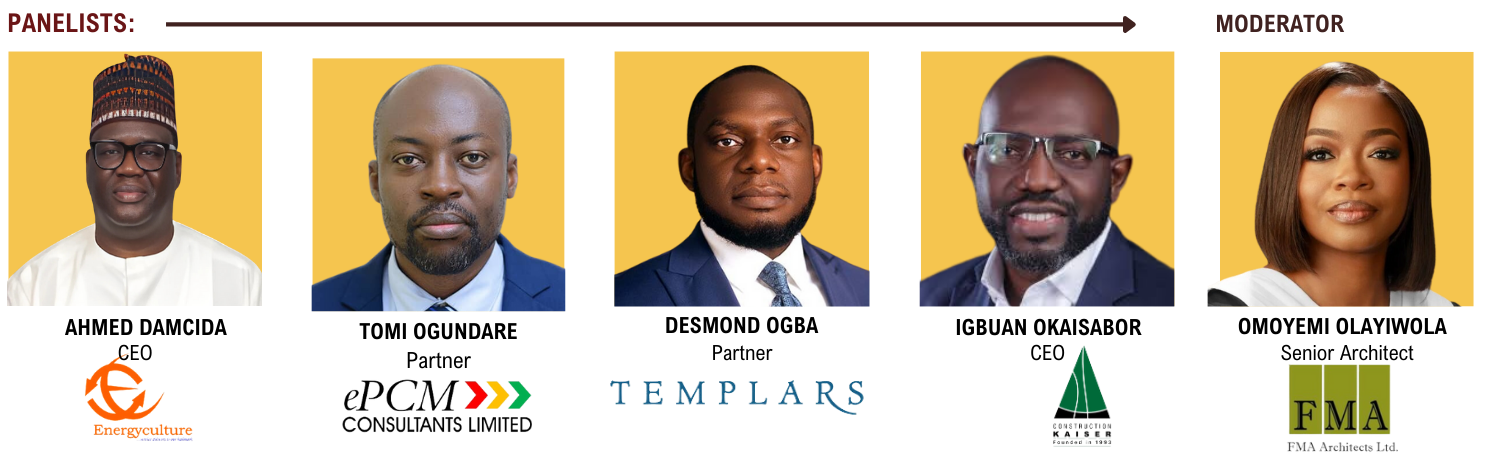

Omoyemi Olayiwola – Senior Architect, FMA Architect Limited

Panelists:

Ahmed Damcida – CEO, Energy Culture

Tomi Ogundare – Partner, ePCM Consultant Limited

Desmond Ogba – Partner, Templars

Session Highlights

Opening Session

The African Catalyst in partnership with Brickstone Africa, Private Equity and Venture Capital Association, Lagos Angel Network, and Women in Energy Network organized the first edition of InfraConnect intending to provide insight to entrepreneurs building infrastructure projects (Infrapreneurs) with perspective on the legal, construction, and design aspects.

The event also featured ten round networking sessions for attendees to share their elevator pitches and make relevant connections with professionals that will contribute to their project success and help in closing the early-stage infrastructure gap.

KEY REMARK SUMMARY

Mr. Femi Awofala began his address by warmly welcoming all attendees and acknowledging their presence. He expressed his appreciation for the valuable contributions of ecosystem partners such as the Lagos Angel Network, Private Equity and Venture Capital Association, and Women in Energy Network, whose support continues to drive impactful conversations around infrastructure development in Africa.

Highlighting his expertise in the sector, Mr. Awofala shed light on the alarming state of infrastructure across Africa. He spoke passionately about the challenges faced, noting the tendency to focus predominantly on infrastructure projects' construction and completion phases while neglecting the critical early-stage development phases. He pointed out that this lack of early-stage attention stifles innovation, hinders progress, and exacerbates the already significant infrastructure deficits on the continent.

Mr. Awofala introduced InfraConnect and Structured Event Networking (SEN), positioning them as platforms designed to address some of the foundational gaps in Africa's infrastructure ecosystem. He outlined their purposes as a bridge between stakeholders, fostering collaboration, and supporting early-stage project development. InfraConnect aims to mobilise resources, connect ideas, and create pathways for sustainable infrastructure investments that can drive economic growth and societal development.

Mr. Awofala articulated a bold vision for African infrastructure, emphasizing the need for innovation and collaboration. He described InfraConnect as a platform that would serve as a hub for early-stage project support and engagement and Structured Event Networking (SEN) as a platform to help us make the necessary connections to close the early-stage infrastructure gap. By leveraging partnerships with private investors, governments, and development organisations, InfraConnect seeks to create a pipeline of bankable projects that can attract funding and generate tangible impacts across African communities.

CONCLUDING REMARKS

Mr. Awofala concluded his address by urging attendees to actively engage with InfraConnect and strike up a conversation with one another. He encouraged attendees to bring forward ideas, share expertise, and partner on transformative projects that address Africa’s infrastructure challenges. In closing, he expressed confidence in the collective power of the ecosystem to unlock Africa’s infrastructure potential.

Video Highlights

Keynote Address

Mel de Nysschen began her keynote address by addressing the numerous challenges facing infrastructure development in Nigeria. She acknowledged the complexities of delivering sustainable and impactful projects in an environment constrained by limited funding, regulatory hurdles, and a growing population. Highlighting infrastructure as a critical driver of economic development, she emphasized how the sector lays the foundation for societal progress, connecting communities, enabling commerce, and fostering innovation.

Drawing comparisons, she pointed out that Nigeria’s infrastructure contribution to GDP remains significantly below the global average (30%), a striking statistic that reflects the infrastructure deficit and its impact on the nation's economic competitiveness. She reiterated the need for stakeholders to adopt innovative approaches, build resilient systems, and prioritize investments in infrastructure to close this gap and unlock the country's vast potential.

In concluding her address, Mel de Nysschen turned her attention to the importance of platforms like the InfraConnect Mixer. She commended the initiative for providing a space where industry players, policymakers, and stakeholders could converge to share ideas, foster collaborations, and develop actionable strategies. She emphasized that the InfraConnect Mixer is not just a networking event but a catalyst for meaningful change, offering solutions tailored to the unique challenges of the Nigerian infrastructure sector.

FInal Remarks

Her final remarks highlighted the mixer’s ability to bridge gaps in understanding and collaboration, creating opportunities to pool resources, share expertise, and align goals across public and private sectors. She urged participants to embrace the platform’s potential to drive sustainable growth, innovate solutions, and set the course for a more resilient and efficient infrastructure landscape in Nigeria.

Register Now for the next InfraConnect session

Early Bird Registration Ongoing!

Panel Session 01

The first-panel session of InfraConnect brought together industry experts to discuss the challenges and opportunities in early-stage infrastructure development in Africa. Moderated by Chinenye Ajayi, the session provided valuable insights into the lifecycle of infrastructure projects, the obstacles faced by developers, and strategies to de-risk projects to attract funding.

KEY DISCUSSION SUMMARY

The session began with a discussion on the characteristics of early-stage infrastructure projects. Ladi Sanni emphasized that this stage involves concept development, where ideas are explored and refined to determine feasibility. Key activities include creating visual presentations, such as slides, to articulate project objectives and potential impacts. He shared an example where his team advised a client to transition from diesel to natural gas for energy needs. The team highlighted the cost-saving benefits, alignment with sustainability goals, and the versatility of natural gas in forms like compressed natural gas (CNG) and liquefied natural gas (LNG). Sanni also underlined the importance of conducting feasibility studies, engaging regulatory stakeholders, and performing environmental assessments to build a strong foundation for project viability.

Femi Awofala provided a structured view of early-stage development, breaking it into three phases: the conceptual phase, where the project’s purpose and scope are defined; the technical viability phase, which focuses on engineering, environmental, and financial feasibility; and the commercial viability phase, which ensures the project aligns with market needs and is bankable.

The conversation shifted to the challenges that prevent many projects from progressing beyond the early stages. Josh Egba highlighted gaps in institutional capacity and expertise, particularly for first-time developers who may lack the technical knowledge to navigate complex projects. He also pointed to time and money constraints, noting that infrastructure projects are resource-intensive, and delays can lead to abandonment. Additionally, he mentioned the role of government policy and regulation, explaining how inconsistent policies and bureaucratic hurdles can stall projects. Limited access to financing further compounds these challenges, as developers struggle to secure funds for essential early-stage activities.

Addressing the risks associated with early-stage projects, Felix focused on systemic issues, including the political and structural environment in Nigeria. He stressed that resolving foundational governance problems is key to reducing risks for investors. Felix also emphasized the importance of creating transparent legal frameworks and ensuring proper contract enforcement to build investor confidence. He advocated for public-private partnerships (PPPs) and technical assistance programs, which can equip developers with the tools and resources needed to address risks effectively.

When asked about what financiers look for in early-stage developers, Femi Awofala advised focusing on low-hanging fruits—projects that are simple, impactful, and easier to execute. He emphasized the importance of data availability and information sharing, which can streamline decision-making for investors. He also highlighted the value of direct agreements between stakeholders to eliminate bottlenecks. Echoing this point, moderator Chinenye Ajayi added that developers should prioritize smaller, impactful projects instead of exclusively targeting large-scale developments.

The panel also discussed success stories in early-stage development. Josh Egba shared an example of a mini-grid project serving 150 communities across Ogun and Nasarawa states. He detailed the structured process the project followed, including securing funding through InfraCredit and implementing a robust business model that aligned with investor expectations. Egba praised the institution’s willingness to go beyond traditional financing mechanisms by providing credit enhancements, which played a crucial role in the project’s success.

The final discussion focused on areas beyond financing that early-stage developers should prioritize. Panellists emphasized the need to understand investor expectations and perform thorough risk assessments to address potential concerns. Developers were encouraged to maintain professional conduct, as trust and strong relationships with stakeholders are critical for long-term success. They should also view projects from a financier’s perspective to anticipate needs and constraints, tailoring their approach to align with investor priorities.

This session offered a comprehensive overview of the early-stage infrastructure landscape, highlighting the importance of strategic planning, stakeholder engagement, and risk mitigation in ensuring project success. The insights shared by the panellists provided valuable guidance for developers navigating this challenging yet rewarding phase of infrastructure development.

QUESTION AND ANSWER SESSION

Audience Member:

What is the possibility of using contingency to de-risk the economic condition of a project, and what percentage is best for contingency?

Femi Awofala:

Femi Awofala responded by emphasizing that the allocation of contingency must be based on the cost estimation process. He explained that contingency is not a fixed percentage but is determined by the robustness and accuracy of the cost estimation method employed. If the cost estimates are derived through detailed feasibility studies and precise assessments, the contingency required may be lower. Conversely, less detailed or approximate estimates might necessitate a higher contingency to account for uncertainties. He highlighted that contingency serves as a buffer to address unforeseen risks and should always align with the specific conditions and risks of the project. Ultimately, the percentage of contingency is a result of a thoughtful and structured process rather than a universal standard.

Register Now for the next InfraConnect session

Early Bird Registration Ongoing!

Panel Session 02

To explore the concept of Early Contractor Involvement (ECI) in infrastructure development, evaluate its merits and challenges, and provide actionable strategies to enhance its effectiveness. The session aims to foster a deeper understanding of how ECI can promote collaboration among stakeholders, balance innovation with risk management, and address legal and contractual complexities, ensuring successful project implementation and sustainable outcomes.

KEY DISCUSSION SUMMARY

The second-panel session of InfraConnect, moderated by Omoyemi Olayiwola, explored the evolving concept of Early Contractor Involvement (ECI) in infrastructure development. The session examined whether ECI is a beneficial approach, strategies to enhance its effectiveness, and the legal and contractual challenges it presents, with all panellists agreeing that ECI offers substantial potential when implemented correctly.

Ahmed Damicida described ECI as a concept with great promise, emphasizing that its effectiveness depends on situational factors. He argued that while ECI can streamline project execution and foster collaboration, its success relies on aligning the approach with the unique needs and conditions of the project. Tomi Ogundare elaborated on this point, emphasizing the importance of ECI in large and technically complex projects. He explained that involving contractors early allows them to contribute to the concept design stage, a critical phase where contractors can identify potential cost-saving measures and innovative solutions that optimize budgets and technical outcomes. Ogundare noted that this collaborative effort ensures the project stays within its financial and operational constraints. Desmond Ogba agreed with the concept, emphasizing that ECI’s true value is realized during implementation, where early insights from contractors lead to smoother transitions into construction and operation.

When asked about strategies to enhance ECI and create a win-win scenario for clients, contractors, and financiers, the panellists proposed several key measures. Tomi Ogundare underscored the importance of selecting the right contractor through rigorous screening processes to ensure the chosen contractors possess the technical expertise, experience, and resources to contribute value. Additionally, he advocated for creating an environment conducive to collaboration, including providing contractors with the technological tools and support needed to enhance efficiency and innovation. Ahmed Damicida added that a thorough design review process is essential to the success of ECI. He cautioned against focusing solely on low-cost proposals, explaining that such options often lead to long-term complications that undermine project sustainability. Damicida emphasized balancing cost efficiency with quality assurance to ensure durable and effective project outcomes.

The panel also explored the balance between innovation and risk management in ECI, particularly in complex projects where technology plays a significant role. While acknowledging the risks inherent in ECI, the panellists agreed that these could be mitigated through well-structured agreements. Ahmed Damicida noted that success in this area depends on achieving consensus among stakeholders on key project elements, including risk-sharing mechanisms, technological objectives, and performance metrics. By aligning expectations early, contractors and clients can incorporate innovative solutions without exposing the project to uncontrolled risks.

The discussion further delved into the legal and contractual challenges associated with ECI and how stakeholders can prevent disputes while fostering collaboration. Desmond Ogba identified exposure to disputes as a major challenge, particularly when one party attempts to back out of agreed-upon contractual obligations. To address this, he recommended establishing a clear contractual framework that defines roles, responsibilities, and deliverables for all parties. He also highlighted the importance of incorporating a compensation mechanism that ensures fairness and transparency in financial and operational responsibilities. Additionally, Ogba proposed a tiered implementation process where compensation and responsibilities are divided into phases, allowing for flexibility and reducing the likelihood of disputes during project execution. While acknowledging that a well-drafted contract cannot eliminate disputes, he emphasized that it provides a solid foundation for resolving conflicts and protecting the interests of all parties.

Panel Session 02 provided an in-depth analysis of the opportunities and challenges of Early Contractor Involvement. The panellists emphasized the importance of tailoring ECI strategies to project needs, fostering collaboration through thoughtful contractor selection, and addressing legal and contractual challenges proactively. Their insights underscored ECI’s transformative potential in modern infrastructure development, provided it is approached with careful planning and a commitment to collaboration.

QUESTION & ANSWER SESSION:

Audience Question:

Where does the cost of Force Majeure and Frustration fall within project planning?

Answer:

Tomi Ogundare explained that one approach is to use the inflation index provided on the Central Bank of Nigeria’s (CBN) website. By referencing the stated inflation percentage, project developers can escalate the contingency allocation for their projects, accounting for potential costs arising from Force Majeure and Frustration events.

Register Now for the next InfraConnect session

Early Bird Registration Ongoing!

Structured Event Networking

The event culminated in an innovative Structured Event Networking (SEN) session, designed to maximize meaningful connections among participants. This segment consisted of ten carefully organized rounds, with each round lasting ten minutes. During these sessions, professionals (project developers) pitched their work in Infrastructure or related fields to a small group of four participants comprising a project enabler and technical consultant, rotating through different groups in each round. This structured approach ensured that participants could forge relevant connections with professionals who could contribute to their project success and help bridge the early-stage infrastructure gap.

Register Now for the next InfraConnect session

Early Bird Registration Ongoing!

Picture Gallery

InfraConnect 1.0

Supporting Partners

Are you interested in Partnering with the African Infraprenuers Programme ?